tax break refund unemployment

Tax season started Jan. 24 and runs through April 18.

Unemployment Tax Break Hoh 3 Dependents Taxes Were Not Withheld During Unemployment Had This Date Of June 14th Pop Up On May 28th Then It Disappeared And Went Back To As Of

Whether youre wondering how to claim the unemployment tax break if you already filed or are getting ready to do so Block has your back.

. A tax break isnt available on 2021 unemployment benefits unlike aid collected the prior year. The federal tax code counts. If youre one of the 25 million of workers who collected unemployment in 2021 youll owe income taxes on all those benefits this tax season unlike last year.

The American Rescue Plan Act waived federal tax on up to 10200 of 2020 unemployment benefits per person. In the latest batch of refunds announced in November however. Already filed a tax return.

Let TurboTax Find Every Deduction To Maximize Your Refund. The average refund for those who overpaid taxes on unemployment compensation was 1265 earlier this year. Ad Answer A Few Questions About Your Life And We Do The Rest.

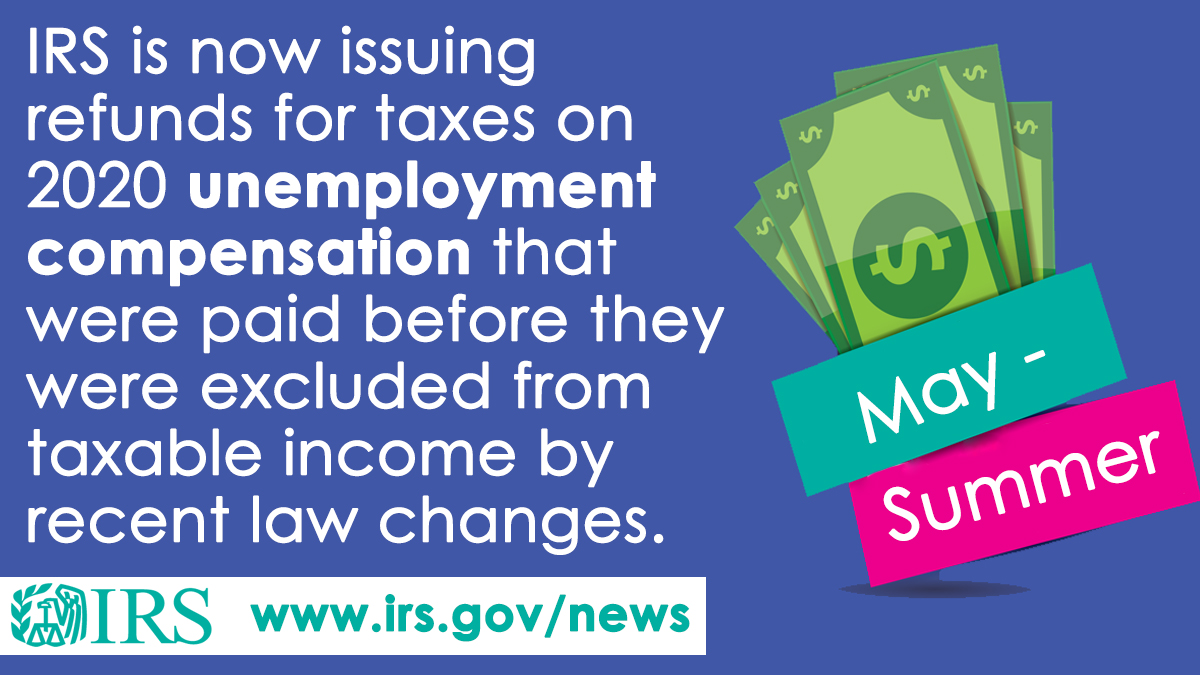

IRS will recalculate taxes on 2020 unemployment benefits and start issuing refunds in May. President Joe Biden signed the pandemic relief law in. In late May the IRS started sending refunds to taxpayers who received jobless benefits in 2020 and paid taxes on that money before the American Rescue Plan went into.

Others knew unemployment compensation would be taxed but feeling the financial strain of paying for rent or buying food for their families opted not to have the funds. The IRS is starting to send refunds to those who paid taxes on their unemployment benefits in 2020. Households who are waiting for unemployment tax refunds can check the status of the payment.

Ad Answer A Few Questions About Your Life And We Do The Rest. This may come as a surprise to workers who got tax relief for the first 10200 of unemployment income they received in 2020 a one-year break provided by the American Rescue Plan. The Tax Break Is Only For Those Who Earned Less Than 150000 In Adjusted Gross.

Since May the IRS has been making adjustments on 2020 tax returns and issuing refunds averaging around 1600 to those who can claim an unemployment tax break. The tax break law was passed in march. Learn More at AARP.

COVID Tax Tip 2021-46 April 8 2021. Taxes Can Be Complex. In late may the irs started.

The 10200 tax break is the amount of income exclusion for. Get Your Max Refund Today. At this stage unemployment compensation received this calendar year will be fully taxable on 2021 tax returns.

The Internal Revenue Service has sent 430000 refunds totaling more than 510 million to people who overpaid on taxes related to their unemployment benefits in 2020. Taxes Can Be Complex. This means if they have one coming to them than most who filed an individual tax return.

The refunds are for taxes paid on unemployment insurance before the american rescue plan act became law in march and excluded up to 10200 in. Ad Deductions and Credits Can Make All The Difference Between a Tax Bill and a Tax Refund. HR Block is here to help.

6 Often Overlooked Tax Breaks You Dont Want to Miss. In most cases if you already filed a tax return that includes the full amount of your unemployment compensation the IRS will automatically. Get Your Max Refund Today.

Kiss tax breaks for unemployment benefits goodbye This means households that didnt withhold federal tax from benefit payments or withheld too little may owe a tax bill or. The American Rescue Plan made 10200 in benefits per person tax-free. Let TurboTax Find Every Deduction To Maximize Your Refund.

If your modified adjusted gross income AGI is less than 150000 the American Rescue Plan enacted on March 11 2021 excludes from income up to 10200 of unemployment.

Unemployment Tax Break Refund How To Check Your Irs Transcript For Clues

Calculate Your Exact Refund From The 10 200 Unemployment Tax Break How Much Will You Get Back Youtube

Over 7 Million Americans Could Receive Refund For 10 200 Unemployment Tax Break

Irs Automatically Sending Refunds To People Who Paid Taxes On Unemployment Benefits The Washington Post

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Irsnews On Twitter Irs Is Correcting Tax Returns For Unemployment Compensation Income Exclusion The First Adjustments Are For Single Taxpayers Who Had The Simplest Tax Returns This Could Result In Refunds For

How Will Unemployment Tax Break Refund Be Sent In Two Phases By The Irs As Com

Irs Unemployment Refunds What You Need To Know

How To Claim An Unemployment Tax Refund And How To Check The Irs Payment Status As Com

Still Waiting On Your 10 200 Unemployment Tax Break Refund How To Check The Status

Interesting Update On The Unemployment Refund R Irs

About 7 Million People Likely To Receive Tax Refund On Unemployment Benefits

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

When To Expect Unemployment Tax Break Refund Who Will Get It First As Com

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time

Transcript Help Am I Getting The Unemployment Refund What Does 291 Mean R Irs

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

What You Need To Know About Unemployment Tax Refunds And When You Ll Get It